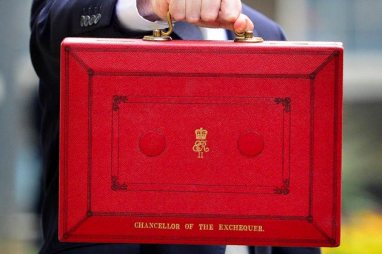

Rishi Sunak gave the Budget speech to Parliament on 11 March detailing the new government’s financial proposals for the forthcoming year. The headlines have focussed upon the measures being allocated to the coronavirus with assistance to the NHS and businesses to cope with the outbreak, however, in the background many of the anticipated changes which could have a severe impact on farmers and landowners across the country have not been implemented.

Inheritance Tax remains unchanged at a rate of 40% tax on chargeable assets at the date of death over and above the nil rate which remains at £325,000 per individual. Agricultural Property Relief (APR) and Business Property Relief (BPR) remain unchanged.

Capital Gains Tax rates again remain mostly unchanged at 10% and 20% on taxable gains, dependant upon the availability of any reliefs, with only adjustments being made to Entrepreneurs’ Relief with the Lifetime Allowance reduced from £10 million to £1 million of taxable gain.

The minor amendments to Entrepreneurs’ Relief have come as a surprise to the industry as more fundamental changes had been talked of and the recommendations from the office for tax simplification had proposed more fundamental changes to Inheritance Tax and Capital Gains Tax with one proposal being that they were both scrapped and replaced with a Lifetime Gift Tax. Great discussion has also been had regarding Agricultural Property Relief and Business Property Relief under Inheritance Tax with the thought of some Accountants that these Reliefs may be removed altogether.

The minor changes made to Capital Gains Tax and the unaltered position regarding Inheritance Tax, leaves the UK with a very benign Capital Gains Tax regime whereby farms and land held by an individual and farmed in hand or with the use of contractors will often be capable of being passed to the next generation without giving rise to a tax liability. Furthermore, the asset may then be sold with little or no Capital Gains Tax liability arising due to the asset value being rebased at the date of death.

Given the continuation of the Reliefs and minor changes to the Capital Tax regime farmers and landowners should plan carefully to ensure that they are maximising the use of these Reliefs both now and in the future and if assets are held and used appropriately to maximise the Reliefs available. There are, however, more often than not grey areas surrounding a farming business with elements of commercial use, unusually large farmhouses, additional cottages not used as part of the farming business and other assets held which do not relate to the main agricultural holding which complicate the tax planning position.

It is not easy to assess and plan for tax without first knowing the value of the individual assets and having taken advice as to their current use and association with the existing farm business. In order to enable correct tax planning professional tax and valuation advice should be sought from qualified professionals with knowledge in the relevant areas and it remains my recommendation that all farmers and landowners should seek advice as to their current options for tax planning as there may be significant benefits and tax savings for assets to be passed to the next generation taking advantage of the current benign tax system.

If you wish to discuss your particular situation we have a dedicated team of RICS Registered Valuers at Lister Haigh who are able to provide expert valuation on a range of property types and work with your Accountants and Solicitors to achieve the most tax efficient property transfers to meet your wishes.

For a confidential discussion please contact our Valuation Team based at our Knaresborough Office on 01423 860322.